By Dr. Ken Broda Bahm:

It might sound like the title for a science fiction series, but in banking a “Dark Pool” refers to a fund that allows anonymous investors to trade large blocks of shares. The tactic is the subject of a recent suit by the New York Attorney General against Barclay’s bank, with the government claiming the tactic creates a lack of transparency and potentially misleads and defrauds investors. To the limited degree that the public understands it, these “dark pools” are just one more example of the kinds of shady dealings that people now assume define the norm and not the exception in U.S. financial institutions.

There may have been a time when American banks and bankers were held in high esteem: honest brokers and custodians of the nations wealth, promoting progress and development. Not any more. Particularly in the wake of the persistent global downturn that started in 2007, banks are increasingly seen as part of the problem. According to our own most recent polling, 36 percent of jury-eligible respondents held unfavorable views of banks in general, and the more familiar the name of that bank (e.g., Bank of America or Wells Fargo), the greater the unfavorable rating. For banks and other businesses engaged in finance, those attitudes matter. Serving as a starting point for litigation, anti-bank attitudes can make some stories more plausible and other stories less so. This post takes a look at data from our own surveys, as well as other recent polling, and shares four themes that seem to stand out in the public’s assessment of banks or other financial institutions.

We have found that it always helps to get beyond the simple metric of “favorability” or “unfavorability” in the public’s assessment. Individuals will have differing views of financial institutions based on a number of factors: their own experiences, their occupations, or the context of recent news events to name a few. But for the last few years at least, several common themes emerge. Based on our own mock trials and focus groups, our surveys of the juror-eligible population, as well as other recent polling, we can say that in the minds of many-to-most, banks and other financial institutions stand out as being…

…Powerful

The public sees banks as having an inordinate effect on the economy, and the expression “Too big to fail,” is acknowledged with regret. As one recent focus group participant said, “We’ve let some of these banks, or whatever, get too big. Period.” The characterization of “banks, or whatever” is meaningful as well, since the image of a bank as something that just holds or invests your money has come a long way. Many people are not really sure what a bank is anymore. But one thing people do believe is that banks, through their decisions and chosen risks, are powerful enough to cause all manner of economic ills from tanking the real estate market, killing jobs, and wiping out savings and retirement.

…Dishonest

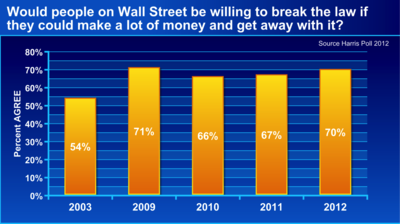

Since the recession, we have seen a solid uptick in the number of people who believe that financial institutions generally are dishonest. Assessing Wall Street, defined as “the nation’s largest banks, investment banks, and other financial institutions,” survey respondents are more likely to believe that a quest for quick profits is enough to motivate dishonesty.

When asked whether the individuals working on Wall Street tended to be as moral as other people, seven in ten in the same survey said “No.” This focus on dishonest business practices has been reflected in our focus group research as well. “If you look at their business case and how they make money,” one of our participants shared, “it’s kind of smoke and mirrors.”

…Unregulated

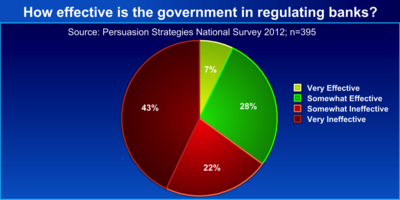

A belief in banks’ fundamental dishonesty, combined with their perceived power over the larger economy, creates a belief that they should be regulated. And indeed, the same Harris Poll reports that more than 80 percent call for greater regulation. Those calls might be blunted, however, by a belief that the government tends to be ineffective in regulating banks. Our own 2012 survey showed that only seven percent felt the government was “very effective,” with only around a third feeling that the government’s regulation was effective at all.

…Unstable

The public continues to have grave doubts about the stability of the financial system and the banks at the heart of that system. Based on a Pew Research survey last September, nearly two-thirds of all Americans (63 percent) believe that the country’s economic system is no more secure now than it was at the time of the 2008 crash. Even as the public perceives some real improvement in real estate and generally minor improvement in the job market, they believe that the system could just as easily crash again.

There are solutions for banking-related companies who need to gain trust in a courtroom, and they are some of the same principles that apply to other large companies:

- Differentiate yourself: Show that your company differs from jurors’ stereotypes of companies like this.

- Emphasize consumer power and choices that still belong to the individual customer/investor and not to the institution.

- Embrace profit motive and show how that motive pushes the company to do the right thing.

- Beat expectations by exceeding regulations for example.

- Be the better teacher by keeping it simple on even the most complicated concepts.

______

Other Posts on Anti-Corporate Bias:

- Bad Company: Investigate the Sources of Anti-Corporate Attitudes

- Take it from Mitt Romney: Corporations Are People Too (Even When They’re on Trial)

- Measure Your Potential Juror’s Anti-Corporate Bias:

______

Photo Credit: Ken Teegardin, Flickr Creative Commons